By YUSUF ISHAKU GOJE

Many Nigerians, particularly Kaduna residents, since the coming of the New Year, have been fixated on debating the American transition process. Sadly, they have forgotten that charity indeed should begin at home; as you do not go peeping into another man’s house when yours is on fire. Many are unaware that the implementation of the 2021 Kaduna state budget commenced on January 1, as signed into law by Governor Nasir Ahmed El-rufai, in December 2020.

The signed budget of N246, 667, 587, 219 is 9 billion naira higher than the proposed N237, 529, 237, 810 sent to the State House of Assembly for appropriation into law. As a result, it increased the capital expenditure to N164, 610, 200, 280, that is 7 billion naira higher than the previously proposed N157, 468, 882, 393. Similarly, the approved recurrent expenditure of N82, 057, 386, 938 is also 2 billion naira higher than the proposed N80, 060, 355, 413 initially sent to the legislature. Out which the government intends to spend N3, 500, 000, 000.00 in servicing its debt.

To finance the budget, with an opening balance of N27, 935, 875, 638.96 – the government is projecting to get N50, 137, 175, 430.94 as statutory allocation; N19, 800, 660, 740.50 as Value Added Tax (VAT); N50,699,968,192.68 as internal revenue; that is in total N120, 637, 804, 364.12 as recurrent revenue for the year. To cover up for the deficit, the government seeks to borrow N46, 916, 696, 000.00 as loans; N50, 177, 211, 215.99 as grants; and N1, 000, 000, 000.00 as other capital receipt; amounting to N98,093,907,215.99 as total capital receipt.

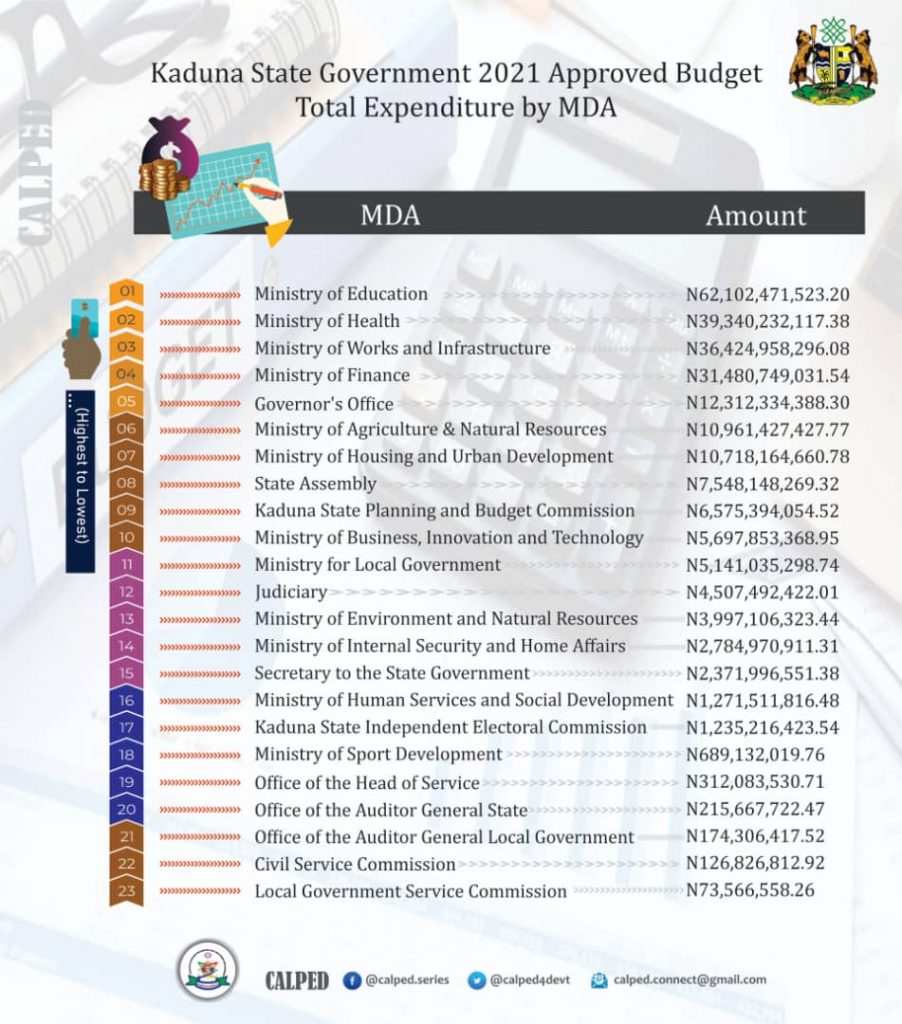

A further breakdown shows that the social sector got an allocation of N112, 541, 489,098.98 (45.6%); followed by the economic sector with N101, 920, 530, 033.44 (41.3%); then the administration sector got N27, 155, 177, 585.72 (11.0%); and lastly the law and justice sector got N5, 050, 450, 500. 92 (2.1%). As expected the top three sub-sectors are education with the highest allocation of N62, 102,471,523.20 (25.2% of the total budget); followed by the health sector with an allocation of N39,340,232,117.38 (15.9%); and then the Ministry of Public Works & Infrastructure which got N36,424,958,296.08 representing 14.8% of the budget.

During the budget signing ceremony at Sir Kashim Ibrahim House, the governor, flanked by top government officials, made an ambitious proclamation by promising to ensure 98 percent capital budget implementation. The budget which is tagged “budget of recovery” to reflect efforts to revamp an economy hit hard by the first wave of the novel corona virus (Covid-19) needs to be given x-rayed in view of the governor’s proclamation and emerging realities. With the second wave of the deadly virus, the budget should no longer be of only recovery but also resilience.

Notwithstanding the foregoing, what stands out in this year’s budget is the 66.7% to 33.3% ratio in favor of capital expenditure; and adoption of the budget classification system as recommended by the World Bank’s State Fiscal Transparency, Accountability & Sustainability (SFTAS) program. The budget also seeks to consolidate on the ongoing infrastructure development with 14.8% of the budget allocated for that purpose. Furthermore, it prioritizes human capital development particularly health (15.9%) and education (25.2%). The state Social protection system is also given a boost with 1% of IGR (N476, 579, 701.01) allocation among many other interventions.

However, the biggest challenge is budget realism, as the 2021-2023 Medium Term Expenditure Framework (MTEF) made available to the public pegged the total Budget Size for 2021 at N158, 772, 916, 036, while the government approved N246, 667, 587, 219. Pundits have argued that this contravenes section 17 of the Fiscal Responsibility Law (2016) which states that the estimates of: “(1) aggregate expenditure and the aggregate amount appropriated by the Legislature for each financial year shall not be more than the estimated aggregate revenue plus a deficit of not more than 5 percent or any sustainable percentage as may be determined by the Legislature for each financial year.”

This it seems has been the trend as political considerations continue to negatively affect budget realism in the state as seen in 2017, 2018, 2019 and 2020 budget performances. The credibility of any budget is when actual spending matches the approved budget – both in terms of overall revenue and expenditure, and in terms of the allocations and spending in specific sectors, such as health or education. No wonder it has been captured in the Sustainable Development Goals (SDGs) framework as an important component of effective institutions (SDG 16) through indicator 16.6.1.

A quick look at the internally generated revenue (IGR) performance shows steady increase over the past years. However, there needs to be clarity if the total amount being declared by the government as IGR also includes collection on behalf of local government areas (LGAs). This is because according to the Kaduna State Auditor-General reports of 2019 out of the N7, 621, 495, 000 statutory 10% due to LGAs, zero naira was disbursed as mandated by law. Also, the partial restrictions of some business activities and the likelihood of another lockdown may have its toll on revenue generation.

On the other hand, the capital expenditure trend indicates that in 2016, 2017 and 2018 there was below or not more than 50% performance, while in 2019 it leaped to 84.21% as a result of the drawdown of the first tranche World Bank P4R Loan. Projections before Covid-19 struck had anticipated capital expenditure performance will be at a minimum of 60% in 2020 and 2021. With this new reality, our saving grace for this year, notwithstanding the ambitious IGR targets, would likely be dependent on the anticipated loans and grants.

The 60:40 budget ratio has been sustained and even surpassed this year as it stands at 66% and 34% for capital and recurrent expenditure respectively. However, looking at budget performance reports shows this has not been adhered to the ratio. Even at that, the performance for capital expenditure only shows releases but does not indicate if they are actually cash-backed.

Importantly, it is pertinent that the government heed the warning in the MTEF 2021-2023 in order to ensure budget credibility, which states in part, “Kaduna State’s gross annual revenues could fall by as much as N17bn if crude oil prices remain around $30 a barrel. The state’s annual revenues could fall by as much as N24bn in 2020 if crude prices fall to $20 per barrel.. Capital projects implementation will be severely curtailed if either of the two oil price scenarios persist except fiscal and monetary policy realism is adopted by the Federal Government.”

Other concerns in the 2021 budget are: the movement of capital expenditure of the Ministry of Human Services & Social Development to other MDAs without the requisite mandate and institutional capacity to implement them. Another concern is the unavailability of evidence that the Community Development Charters submitted to the government were captured in line with commitment one of the Open Government Partnership (OGP).

In general, despite the challenges of budget credibility, the budget has a lot of pro-people interventions which with adequate spending and proper implementation would meaningfully touch the lives of especially the poor and vulnerable in the state.

God bless Kaduna State